My name is Zeeshan Shabbir, and I founded Million News Media. Formerly known as Stocks Telegraph, we continue to operate our platform, Stocks Telegraph, dedicated to providing simplified and accessible financial information for investors.

Can you provide a short overview of your business and the problem it tries to solve?

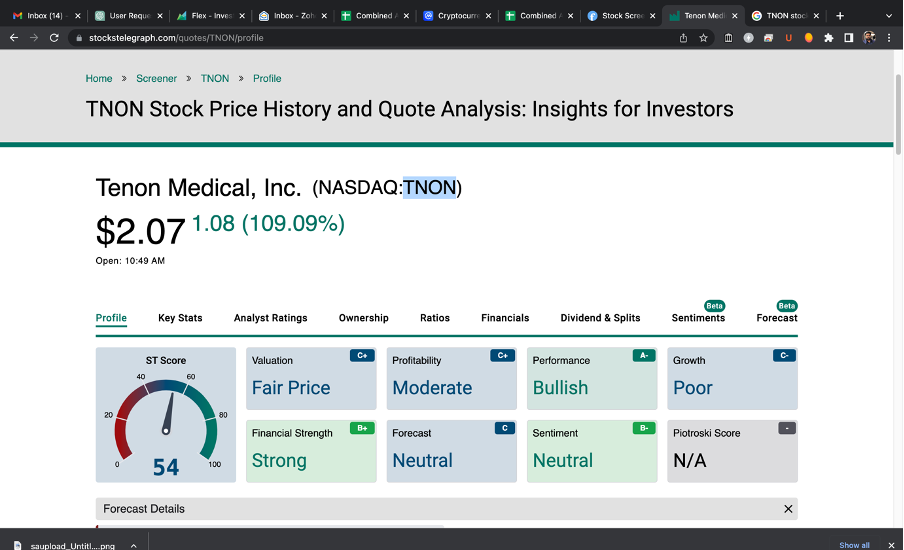

Million News Media, formerly Stocks Telegraph, is a digital financial platform designed to streamline the information avalanche in the stock market world. Our primary platform, Stocks Telegraph, is engineered for novice and seasoned investors, addressing the common pain points they face in the ever-evolving financial landscape.

At the heart of our offering is the commitment to simplify complex financial data. We understand that in today's fast-paced financial world, investors are often overwhelmed with scattered information, paywalled insights, and time-consuming stock analyses from multiple websites. Stocks Telegraph consolidates this information, providing curated news, earnings reports, analyst ratings, forecasts, and more in a user-friendly interface. This consolidation saves time and aids investors in making informed decisions.

Moreover, our advanced stock screener, sentiment analysis, and grading system tools ensure that our subscribers get a comprehensive view of the stocks they are interested in. By addressing these challenges, we are essentially bridging the gap between intricate financial data and actionable insights.

Our platform's success is evident in the substantial subscriber growth for our morning newsletter. Furthermore, the positive response from our North American audience solidifies our position in the market, further emphasizing our value proposition.

What’s your background, and how did you come up with the idea?

Before launching Million News Media, I, Zeeshan Shabbir, embarked on a diverse entrepreneurial journey over a decade. My initial venture, Brilliant Innovators, was birthed from a freelance project, which subsequently led to a collaboration with a US holding company, Crown Equity Holdings. Here, we managed two offices with over 60 employees. This phase, although rewarding, was filled with challenges, including navigating abrupt contract terminations, which tested my resilience and adaptability.

Post this experience, my team and I ventured into the digital space, pivoting towards blogging and harnessing the power of AdSense. The landscape evolved, and in collaboration with partners like Adam Graica and Yemani Mason, we dipped our toes into email marketing, mainly focusing on penny stock promotions. This era saw us navigating the peaks and troughs of digital revenue, marking significant highs during our partnership.

During these iterative phases, coupled with my undying passion for the financial markets, the idea for Stocks Telegraph under Million News Media took shape. Recognizing the fragmentation of financial data, the difficulties investors face in accessing reliable information, and the potential of AI in bridging these gaps, I envisioned a platform that simplified financial information. The transition from scattered data to consolidated, actionable insights was not just a business idea but a solution to a genuine problem faced by countless investors.

Today, as we operate Stocks Telegraph, the connection between my past ventures and the current platform is clear. Each previous endeavor contributed a building block, culminating in a comprehensive solution that is a testament to my journey, resilience, and commitment to innovating within the financial space.

How did you get your first customers during the early stage of the company?

When we initiated Stocks Telegraph under Million News Media, we significantly emphasized organic growth. Our initial approach was to provide valuable content resonating with our target audience, ensuring it was relevant and accessible. This organic strategy was soon rewarded when we secured a partnership with Google News, which marked a pivotal moment in our growth trajectory. The exposure through this platform led to a surge in organic traffic and positioned us as a reliable source of financial information.

Recognizing the potential of our growing visitor base, we began collecting email addresses and introduced our morning newsletter. This meticulously crafted newsletter offers insights into key market indexes, insider activities, anticipated earnings reports, and other pivotal financial highlights. Our primary tactic to ensure the newsletter's success was feedback-driven evolution. We frequently conducted surveys, gathered our readers' feedback, and refined our offerings accordingly. This approach not only improved our product but also deepened the trust in our community.

Fast forward to today, and we proudly serve over 17,000 subscribers, a testament to our commitment and the value we bring. Our trust-based community is not just a group of passive readers but active participants who engage, contribute, and rely on our platform. As we look to the future, we're excited to introduce paid plans, enhancing our tools like the grading system and competent screener, ensuring that Stocks Telegraph remains an indispensable resource for investors globally.

How’s the business doing today?

Currently, Million News Media, operating our flagship platform, Stocks Telegraph, is experiencing robust growth. We've successfully built a subscriber base of over 17,000 dedicated readers for our morning newsletter, which continues to grow daily. While I prefer to keep the exact annual revenue confidential, I can share that our Monthly Recurring Revenue (MRR) has witnessed a steady uptick, with figures indicating a substantial percentage growth year-on-year.

Beyond the numbers, what's truly fascinating about our journey is the community's trust we've nurtured. Our commitment to evolving based on feedback and our endeavors, like the grading system and competent screener, ensure we stand out in the crowded financial information space. The business, in essence, is not just about figures but the value we bring to our users, making financial insights both accessible and comprehensible.

Presently, what marketing channels are working well to acquire customers?

Organic Growth: Million News Media's marketing strategy's foundation is organic growth. A significant portion of our website's traffic comes organically through search engine results. We've optimized our content meticulously for SEO, ensuring we consistently rank high on search queries related to financial news and stock insights. Our analytics data showcases a steady rise in organic visitors month over month, indicating the effectiveness of our content strategy.

Partnerships: One of our pivotal moves was forming partnerships with esteemed platforms like Google News and Bing News. Being featured on these platforms significantly increased our visibility and added a layer of credibility to our brand. These partnerships have directly translated to higher traffic and increased subscription rates.

YouTube Channel: While traditional content remains our stronghold, we understand the shift towards video content, especially among the younger demographic. We've been actively building our YouTube channel, producing engaging videos on stock analysis, market trends, and financial tutorials. The early metrics from our YouTube analytics are promising, showcasing increased viewer retention and a growing subscriber count.

Feedback-Driven Email Campaigns: Our morning newsletter has over 17,000 subscribers and has been a vital touchpoint. We regularly run feedback surveys through this channel, which gives us insights into user preferences and helps us tailor our content. By adapting our offerings based on real-time feedback, we've seen a consistent improvement in open and click-through rates.

We continually analyze our marketing campaigns using tools like Google Analytics. While exact screenshots or detailed reports are proprietary, I can confirm that our efforts have translated to positive trends in user engagement, page views, and overall brand recognition.

What has been your biggest achievement as a founder?

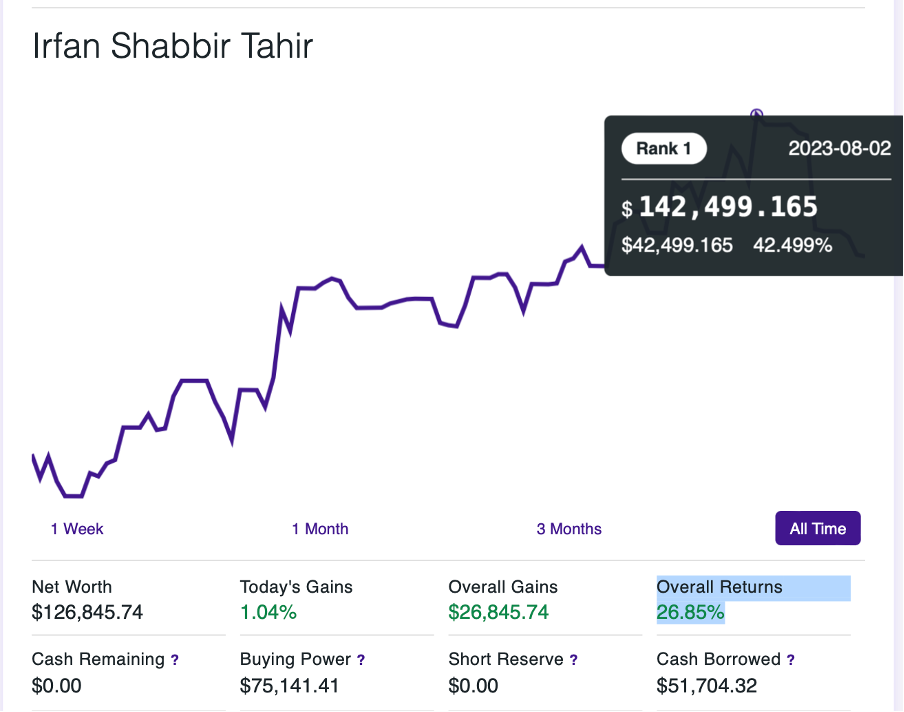

One of the hallmarks of my journey as the founder of Million News Media has been the development and deployment of our innovative stock grading system. This endeavor required financial acumen and a deep dive into data analytics and predictive modeling complexities. When we first conceptualized it, the ambition was to create a tool that could provide accurate, actionable insights to investors, allowing them to make informed decisions in the volatile world of stocks.

It was a defining moment when we tested this system and witnessed a staggering 42% return at its peak. What added to the celebration was our performance benchmarked against renowned indices; beating the S&P by a whopping 38% during the same period was a testament to the system's prowess and effectiveness. For a platform that's still in its beta phase, such accomplishments not only bolster our confidence but also underscore the potential of what we have built.

Beyond the numbers and the financial metrics, this achievement has validated my vision for Million News Media. It’s a demonstration of our commitment to innovation and our continuous pursuit of excellence, and I am incredibly proud of the strides we've made.

What has been your biggest challenge since the company's inception?

Since founding Million News Media and launching our platform, Stocks Telegraph, one of our most significant challenges has been navigating the complex landscape of financial information dissemination. The market for financial news and insights is saturated, with many established players and a constant influx of new entrants. Distinguishing ourselves and gaining users' trust amidst this noise was no small task.

We confronted this challenge head-on by emphasizing quality, relevance, and innovation. Instead of merely replicating what existed, we sought to carve a unique space for ourselves by introducing tools and services like our proprietary stock grading system. Furthermore, as a newcomer, we recognized the importance of partnerships. Our collaboration with platforms like Google and Bing News immensely boosted our organic reach, providing us a much-needed edge in this competitive space.

Additionally, understanding and adapting to the rapidly evolving expectations of modern retail investors required continuous feedback loops. By actively soliciting and integrating user feedback, we ensured that our offerings remained relevant, user-centric, and ahead of the curve, allowing us to overcome this challenge and thrive.

What’s something you know now that you wish you had known when you started the company?

Looking back, I wish I had grasped the importance of user feedback and community building earlier in our journey. While we always aimed to deliver top-notch services and tools, our initial approach was largely prescriptive. We believed we knew exactly what the users wanted and designed our offerings around that assumption. Over time, I've learned that while vision and innovation are crucial, they should be in tandem with what your audience genuinely seeks.

Another valuable insight I've garnered is the unpredictability of the startup ecosystem. While having a plan is essential, being too rigid can be counterproductive. Many unforeseen opportunities and challenges arise along the way, and agility is crucial. If I could advise my younger self, I'd emphasize the importance of remaining flexible and being open to change, even if it means deviating from the original plan.

Lastly, I wish I knew the significance of partnerships and collaborations from the get-go. While we eventually formed meaningful collaborations, like with Google and Bing News, realizing the power of such alliances earlier could have accelerated our growth trajectory and fortified our market presence more swiftly.

What advice would you give to new entrepreneurs?

Embarking on an entrepreneurial journey is both thrilling and daunting. My foremost advice to budding entrepreneurs would be to engage deeply with their customers. It's easy to get lost in your vision for your product, but at the end of the day, the customers' needs and preferences will determine your success. Regularly converse with them, understand their pain points, and incorporate their feedback. This two-way dialogue will refine your offering and foster trust and loyalty among your user base.

Additionally, be clear on your goals, but be prepared to dissect them into manageable milestones. This helps keep the momentum and ensures that the bigger picture doesn't overwhelm you. Staying plugged into the startup ecosystem can be a game-changer. It exposes you to diverse perspectives, new methodologies, and potential collaborations. Lastly, never underestimate the power of iterative research on your target market. As the market evolves, so should your understanding of it. Keeping these facets in mind while navigating the intricate world of entrepreneurship will significantly enhance your chances of crafting a solution that resonates and succeeds.

How do you keep yourself motivated?

Staying motivated requires intentional habits and practices, especially in the roller-coaster entrepreneurship journey. For me, beginning each day with a straightforward routine has been instrumental. I typically start my mornings with a blend of meditation and visualization exercises, allowing me to center myself and reinforce the larger vision of my endeavor. It is a grounding force, reminding me of the 'why' behind my venture, especially during challenging times.

Resources have played a pivotal role as well. Books like "The Hard Thing About Hard Things" by Ben Horowitz and "Atomic Habits" by James Clear have provided perspective and actionable insights. Podcasts featuring startup stories, such as 'How I Built This,' serve as regular reminders of the challenges faced by other entrepreneurs and the tenacity with which they tackled them. These narratives constantly reinvigorate my passion and fuel my drive to forge ahead, no matter the obstacle.

What are your plans for the next 6-12 months?

At Million News Media, our sights are set high. We don't just envision Stocks Telegraph as a leading platform in the financial information space, but we aim to build a billion-dollar enterprise. Our commitment goes beyond business metrics; it's about a mission. We are deeply passionate about leveling the playing field for retail investors, providing tools that reduce their research time and empower them to make timely and informed decisions.

Our upcoming enhanced stock grading system, educational webinars, and courses are steps in this direction, and they are only the beginning. We recognize that to build a billion-dollar company; we must constantly innovate and stay ahead of the curve, ensuring our offerings remain relevant and impactful.

In terms of outreach and visibility, we're adopting a multifaceted approach. Apart from strengthening our organic partnerships with Google and Bing News, our paid marketing strategy is set to evolve. We're not just looking at traditional channels like social media ads. We believe in the power of innovative tactics such as strategic partnerships, cross-selling opportunities, and collaborative ventures. These avenues allow us to penetrate deeper into our target markets and continuously expand our user base.

With these plans and strategies in place, we are on a trajectory that doesn't just aim for success but for industry leadership and significant impact in empowering retail investors.

Where can people get in touch with you?

Email: [email protected]

Linkedin: https://www.linkedin.com/in/zee shabbir/https://www.stockstelegraph.com/contact-us